Odoo

5 MIN READ

August 19, 2022

![]()

It doesn’t matter if you’re just starting out or if you’ve been running your business for years.

You’ve been managing your financial transactions through spreadsheets since the necessity of bookkeeping is indispensable for every businessman.

In today’s fast-paced digital world, where solutions can be acquired in seconds, you must have started realizing that you have already spent too much of your business hours managing your books on spreadsheets.

This has kept you away from many other opportunities like deploying new customer acquisition strategies, meeting new leads, and much more.

Now you’ve come all way from Google to research the right bookkeeping and accounting software for your business needs but are still unsure to make the right choice. Let’s take a moment to read this article and learn what’s holding you back.

It must have been your inner conscience that made you say this when you realized spreadsheets were proving to be time-consuming.

Nevertheless, it is true! During the initial years of a business, spreadsheets perform to be the best fit for the management of business finances. However, they are always a temporary solution when it comes to the best permanent accounting solutions.

If you picture yourself hovering over multiple spreadsheets composed manually with financial data that cannot be verified for accuracy, it is a grim scenario.

According to research, 57% of accountants believe permanent accounting solutions are

crucial skills for future employees.

Spreadsheets could be free to use but even an error of a single decimal can turn your bookkeeping records into chaos. In our quest to keep accounting data error-free in spreadsheets, we all spent more time than we would like to admit.

Need not to worry, here’s the good news: The Dynamic Financial Report by Ksolves makes every accounting and bookkeeping hiccup into a positive experience. Additionally, spreadsheets are much more complicated and time-consuming than the application.

Adding another bonus to that, Ksolves also offers free 120 days of robust tech support as well as free lifetime updates. Moreover, the software is available online, you can access all your books on the go from anywhere on the planet.

There is no such thing that overshadows anything available free of cost, especially when you’re tracking every buck. It becomes even harder to think for a change once you have already compiled your years into spreadsheets.

However, the cost of the Dynamic Financial Report by Ksolves was set keeping entrepreneurs and small businesses in mind. It’s so much more affordable than your monthly internet bills or ordering pizza once a week. Downloading Ksolves’ Dynamic Financial Report could eventually result in being economical for all your business verticals.

Yes, that sounds affirmative! This is mostly the case when you are already short of hiring a professional bookkeeper. How much time will you manage to track every transaction, payment, and invoice? Even if you’re a small business owner then ideally you’re likely to spend more than half of your business hours on bookkeeping and accounting requirements.

When you have to manage all your accounting records manually, you will be spending a great deal of time and effort. In contrast, the Dynamic Financial Report App by Ksolves is an easy-to-use, robust, and economical accounting and bookkeeping tool that serves the needs of different business owners seamlessly.

When you are already a business owner, you can easily see how this app can save you from losing crucial business hours where you could have made a lot of money. The initial investment that businesses made into switching from spreadsheets to Ksolves’ Dynamic Financial Report is now their capital expenditure.

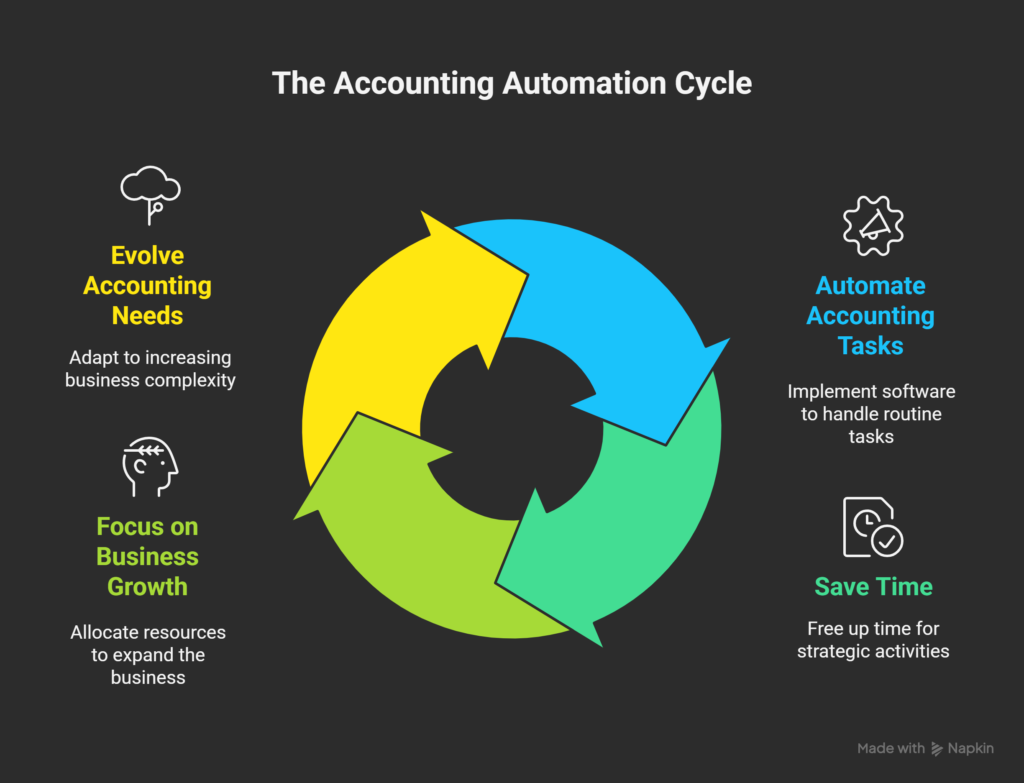

As the business evolves, the accounting seeds start expanding their roots in the form of numerous invoices, books, etc. As your business grows, your accounting also becomes more difficult.

You need to create more invoices, make new journal entries, create financial statements, and the list goes on. That’s why, in this day and age, most businesses use accounting software to manage their accounting.

Accounting software such as Ksolves’ Dynamic Financial Report can help you automate most steps of the accounting cycle, allowing you to spend time on what really matters, like growing your business.

If this sounds like the last book you managed, then it’s time to start stealing. It is the great players who steal the show, not the good players. In this subsection, we’ll focus on the features and benefits of Dynamic Financial Report by Ksolves that every accountant should know about.

Excel spreadsheets serve the purpose of basic bookkeeping, one can use them to track their income and expenses, tag transactions, and keep track of invoices sent out. However, as your business grows, organizing your books manually can jeopardize your position.

Here is where the Dynamic Financial Report seamlessly fills all your pain points; it includes features such as “Differentiate Filter, and Send Email” so that users can simplify their accounting records with minimal human intervention.

Using an accounting and bookkeeping solution like Dynamic Financial Report, you can eliminate most of the accounting errors.

An accountant would always love to steal functionalities of this app where they can create and customize their own reports with ease.

Having the ability to create and customize reports with ease is a feature of this bookkeeping and accounting tool that every accountant would love to have in their app.

Moreover, a user can create a report in a new format and incorporate it with an existing parent report.

Do you recall the times when you spent hours trying to figure out the sustainability of the balance sheet?

Well, you can put an end to those times now.

The digital age has made manual work a thing of the past. Today, nobody wants to bind themselves to time-consuming spreadsheets.

Accounting software, such as Ksolves’ Dynamic Financial Report, provides on-the-go access to all financial data, including journal entries, financial statements, and reports.

By viewing every aspect of data through Dynamic Financial Report, one can detect minute shortcomings, make sense of the financial situation of the company, and discuss them with the appropriate people.

You don’t need spreadsheets when you can keep track of your books with a robust bookkeeping tool like Ksolves’ Dynamic Financial Report.

With the Dynamic Financial Report, you can easily check the accuracy or tally of a report against previous reports of various periods (months, quarters, etc.).

Dynamic Financial Report let you compare the financial report with various date filters to visualize where the business is headed for.

Having such type of functionalities gives accountants instant access to the books without the clutter on their desks.

So, instead of spending time on bookkeeping, use Ksolves’ Dynamic Financial Report to replace manual calculations and speed up bookkeeping operations.

Now, optimize your operations with one-click access to multiple business records so you no longer have to increase resources in multiple places.

Excel spreadsheets may be the best option if you need to track your small business finances using single-entry accounting. However, if your business is growing then it will soon become a hassle to use Excel for your accounting needs.

Therefore it may make sense to relocate your books and business plans rather than accommodate them later on a bookkeeping and accounting software like Dynamic Financial Report. Moreover, this module is so simple and efficient to use that even a user from non-technical background can do financial reporting seamlessly.

You may find it difficult to keep up with your bookkeeping records as your business grows if you use Excel to manually manage them. In the long run, time is money, so automate your accounting workflows with Ksolves’ Dynamic Financial Report to keep up with the times.

It’s important to note that your business’s performance will also depend on your personal factors, with some of us plotting to improve every aspect, while others will simply make sure it keeps running.

Using spreadsheets can give a process to your accounting operation but if you’re aiming for the big numbers then an accounting software like Dynamic Financial Report by Ksolves may prove as a game-changer in the long run, freeing up your time to handle other aspects of your business.

It’s time to wrap things up. Now that you know the advantages of Ksolves’ Dynamic Financial Report, let’s take a look at those benefits.

This is why bookkeeping and accounting software such as Ksolves’ Dynamic Financial Report isn’t just for the sake of convenience anymore, but a necessity for today’s enterprises. In comparison to spreadsheets, it provides your accounting operations with greater accuracy and connectivity.

You can find answers to most of your questions about the Dynamic Financial Reports app in this sub-section.

1. Whom to contact in case of any customizations?

To obtain additional customizations, please contact us and describe exactly what you require. There is no doubt that we will be able to assist you.

2. Who is the most likely to benefit from Dynamic Financial Report?

Using the app, businesses of any size can generate a variety of reports with a single click. Investing in the app will pay off for small businesses as well as medium and large enterprises.

3. How does the ‘Differentiate Filter’ work in Dynamic Financial Report app?

This filter lets you compare one report with another (different time segments) using the ‘Differentiate filter’. By comparing the results, you will be able to understand the new report’s financial standing.

4. What is an Analytical Account in the Dynamic Financial Report App?

Generally, reports primarily summarize the overall details of various products, combining them into one report. If you want to know the transaction history (credit/debit details) of a particular product, what should you do? The analytical account is useful for this purpose. You can check the credit/debit history of a specific product using an analytical account without affecting the original report’s details.

![]()