Odoo

5 MIN READ

January 12, 2026

![]()

Financial clarity isn’t just for large corporations. For small businesses, having accurate, up-to-date financial data is the key to survival and scalability. Whether you’re tracking expenses, managing cash flow, or preparing for investors—traditional reporting methods simply can’t keep up.

Static, outdated spreadsheets give you yesterday’s view of your business. But what if you could see today’s numbers—live?

Real-time financial reporting empowers you with accurate, dynamic insights when they matter most. This blog explores why it’s essential, how to build effective reports, and how you can use Odoo’s Dynamic Financial Report to automate and optimize your reporting process.

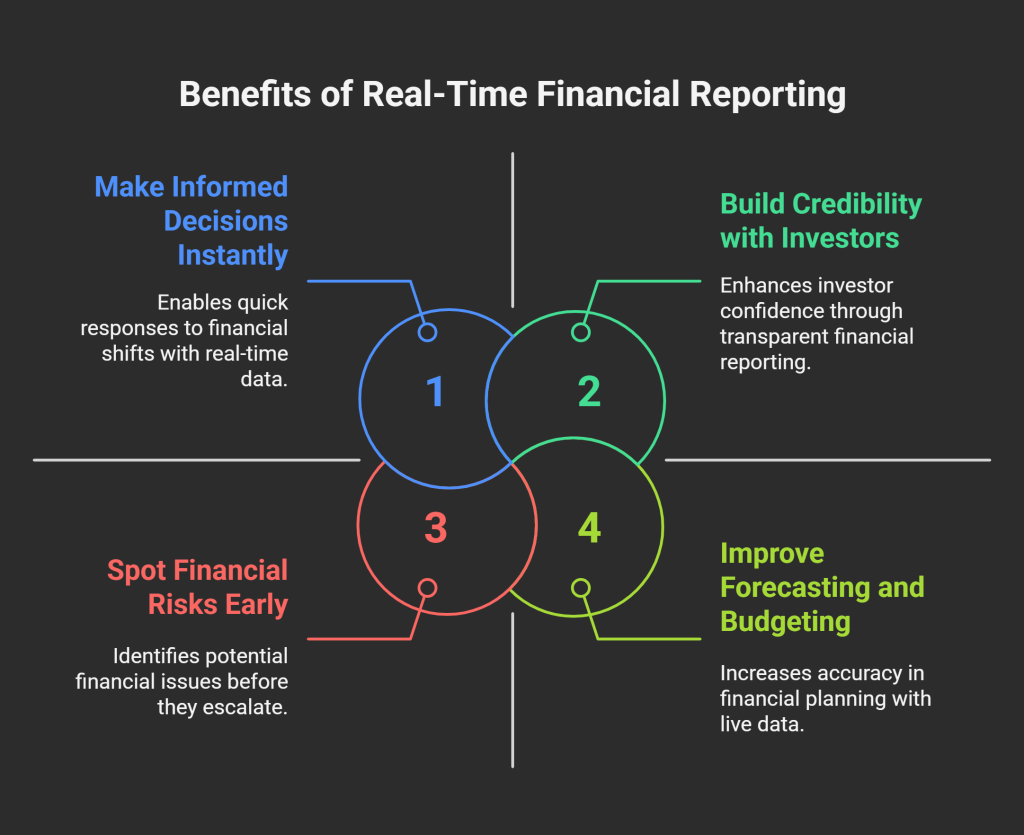

Timely financial insights can make or break your business decisions. Here’s why real-time reporting is essential:

No more waiting until month-end to review numbers. Real-time reports let you respond quickly to shifts in cash flow, sales performance, or operating costs—ensuring your actions are always grounded in facts.

When you have access to live data, forecasting becomes far more accurate. You can model future revenue, anticipate cash flow gaps, and stay within budget without guesswork.

Real-time data can reveal red flags—like overspending departments, delayed receivables, or declining revenue—before they spiral into major issues.

Stakeholders want transparency. Up-to-date reports enhance investor confidence and make fundraising, auditing, or compliance much smoother.

Before embracing real-time reporting, it’s important to understand the obstacles small businesses typically face:

Many SMEs still rely on spreadsheets and disconnected systems. These methods are error-prone and time-consuming, leaving room for data discrepancies.

Without a centralized platform, teams may struggle to consolidate numbers from accounting, sales, HR, and inventory systems, resulting in inconsistent or incomplete reports.

Most out-of-the-box tools don’t let you tailor financial reports to your unique business needs—like project-level tracking, departmental profitability, or custom fiscal calendars.

Sensitive financial data should be shared selectively. But many systems don’t allow detailed user permissions or control over who sees what.

Ready to move beyond spreadsheets? Here’s a step-by-step approach to implementing powerful real-time reporting:

Look for a solution that integrates with your ERP (like Odoo) and pulls data from across your business in real time. It should support multiple report types, filters, and custom views.

Don’t just collect data—measure what moves the needle. Examples include:

Create templates for your most critical reports—like Profit & Loss, Balance Sheet, or Cash Flow—then schedule them to run and share automatically with stakeholders.

Enable users to filter by date, department, partner, or account and drill down to the journal or transaction level. This makes reports both high-level and deeply actionable.

Give department heads, finance teams, and executives personalized access to only the reports they need, with controlled visibility and editing rights.

Retail Business

Track sales, expenses, and profit by store location in real time. Identify high-performing outlets, monitor seasonal trends, and optimize promotions accordingly.

Manufacturing Company

Monitor material costs, production overheads, and cost per unit as they change. Adjust prices or supply chain strategies before costs impact your bottom line.

Tech Startup

Monitor Monthly Recurring Revenue (MRR), churn, and runway. Real-time metrics help your leadership team present up-to-date financials to investors at any time.

Consulting Firm

Track billable hours, project-level profitability, and client-wise revenue in real time to ensure accurate billing and client forecasting.

Built by Ksolves, the Dynamic Financial Report app brings the power of real-time reporting directly into your Odoo environment.

Whether you’re a founder, accountant, CFO, or department head—this tool offers tailored insights without the need for coding or manual report-building.

For Accountants

Speed up the month-end close with accurate, real-time data. Automate routine tasks, reduce manual errors, and streamline compliance and audit preparation.

For Executives & Business Owners

Gain a 360° view of your company’s financial health. Instantly monitor profitability, cash flow, and performance across products, departments, or regions—all in one dashboard.

For Investors & Auditors

Access standardized, transparent financial reports with complete audit trails. Export data in your preferred format (Excel, PDF) and eliminate back-and-forth delays.

For Department Heads & Operational Teams

Drill into department-specific budgets, spending, and targets. Stay informed, accountable, and empowered to make faster, data-driven decisions without relying on finance teams.

Explore Dynamic Financial Report on the Odoo App StoreStart today and unlock smarter decision-making for your business.

If you’re tired of outdated spreadsheets and reactive reporting, it’s time to take control with real-time financial insights.

With Ksolves’ Dynamic Financial Report, you’ll gain transparency, speed, and strategic clarity—all from inside your Odoo environment.

Q: Is Dynamic Financial Report compatible with the latest version of Odoo?

Yes, it’s fully compatible with Odoo 18 and earlier versions.

Q: Can I create custom financial reports?

Yes. You can build, filter, group, and schedule reports based on your specific metrics.

Q: Is it user-friendly for non-financial users?

Absolutely. The UI is clean and intuitive, with no coding required.

Q: Can I restrict access to reports?

Yes, the app supports role-based access, so users only see what’s relevant to them.

Q: Does it support multi-currency environments?

Yes, making it ideal for international businesses.

![]()